Hard Money Georgia Things To Know Before You Buy

Wiki Article

The 8-Minute Rule for Hard Money Georgia

Table of ContentsWhat Does Hard Money Georgia Mean?Some Known Facts About Hard Money Georgia.Some Known Details About Hard Money Georgia Not known Factual Statements About Hard Money Georgia How Hard Money Georgia can Save You Time, Stress, and Money.

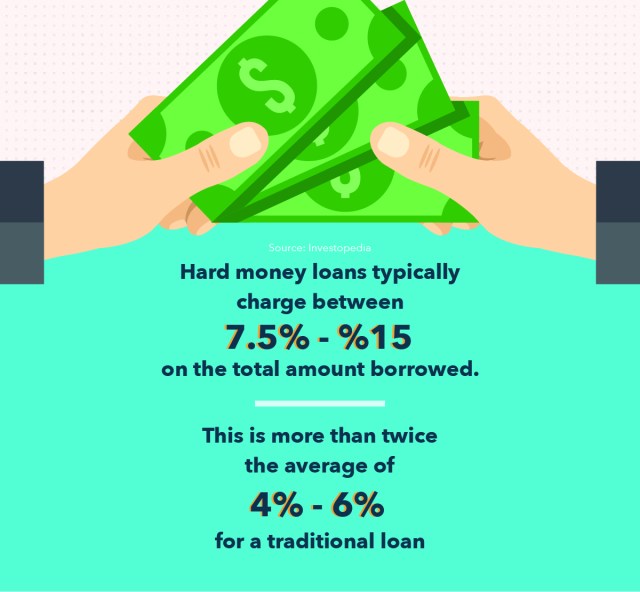

, are short-term borrowing tools that real estate capitalists can make use of to fund a financial investment task.There are two main disadvantages to think about: Difficult money loans are hassle-free, but investors pay a price for borrowing this means. The rate can be approximately 10 percentage points more than for a conventional finance. Origination fees, loan-servicing fees, and also closing prices are likewise most likely to set you back investors a lot more (hard money georgia).

As an outcome, these loans include much shorter payment terms than standard home mortgage car loans. When picking a difficult money lending institution, it's crucial to have a clear suggestion of exactly how soon the home will certainly end up being lucrative to guarantee that you'll be able to repay the financing in a timely manner.

Not known Facts About Hard Money Georgia

You may have the ability to customize the repayment routine to your requirements or get specific costs, such as the source charge, lowered or gotten rid of during the underwriting process. With a difficult cash loan, the property itself usually works as collateral for the car loan. However once more, lenders may enable capitalists a little leeway right here.Difficult cash loans are a good suitable for wealthy capitalists that require to obtain financing for a financial investment property quickly, with no of the bureaucracy that supports financial institution funding. When reviewing hard money lending institutions, pay very close attention to the fees, passion rates, as well as lending terms. If you wind up paying excessive for a difficult money financing or cut the settlement period also brief, that can influence just how successful your real estate venture remains in the future.

If you're seeking to purchase a residence to turn or as a rental property, it can be challenging to obtain a standard home mortgage. If your credit report isn't where a standard lending institution would like it or you require money faster than a loan provider is able to provide it, you might be out of good luck.

The smart Trick of Hard Money Georgia That Nobody is Discussing

Difficult money fundings are temporary safe financings that use the residential or commercial property you're buying as security. You will not discover one from your bank: Hard cash loans are supplied by alternative lenders such as private financiers and personal business, that generally overlook sub-par credit report and other financial factors and also instead base their decision on the residential property to be collateralized (hard money georgia).

Difficult cash financings provide several advantages for customers. These include: Throughout, a difficult cash funding could take just a few days. Why? Tough money lenders often tend to put even more weight on the value of a property used as collateral than on a customer's finances. That's because tough cash loan providers aren't called for to adhere to the exact same guidelines that traditional lending institutions are.

While tough money lendings come with advantages, a customer should likewise think about the risks - hard special info money georgia. Amongst them are: Difficult cash loan providers typically bill a greater passion price due to the fact that they're presuming more danger than a conventional lender would certainly.

Not known Details About Hard Money Georgia

You're uncertain whether you can manage to pay off the difficult cash loan in a short amount of time. You've got a strong credit history and also should be able to qualify for a typical car loan that most likely lugs a lower rates of interest. Alternatives to difficult money financings include traditional home loans, house equity loans, friends-and-family fundings or funding from the home's vendor.

Hard Money Georgia Things To Know Before You Buy

It is essential to think about factors such as the lender's online reputation and also rates of interest. You may ask a Our site trusted real estate representative or a fellow home flipper for recommendations. As soon as you have actually nailed down the best hard money lending institution, be prepared to: Develop the down settlement, which generally is heftier than the down settlement for a traditional home mortgage Collect the required paperwork, such as evidence of income Possibly employ an attorney to look at the regards to the financing after you have actually been authorized Draw up an approach for settling the lending Simply as with any type of car loan, review the advantages and disadvantages of a tough money loan before you dedicate to loaning.No matter what sort of finance you choose, it's possibly a good suggestion to check your cost-free credit report and also totally free credit report with Experian to see where your funds stand.

When you hear words "tough money finance" (or "private money loan") what's the very first point that undergoes your mind? Shady-looking loan providers that conduct their service in dark streets and charge overpriced rate of interest? In prior years, some negative apples stained the hard money offering market when a couple of predatory lending institutions were attempting to "loan-to-own", offering extremely high-risk car loans to consumers using realty as security and also planning to confiscate on the residential properties.

Report this wiki page